Pro-AV Business Index

January starts strong

Highlights

The AV Sales Index (AVI-S) for January registered 55.6, easing from December’s 56.6 and reflecting a typical start-of-year moderation in AV demand. The pullback is consistent with seasonal patterns, as education, corporate, and live events markets pause amid calendar resets, budget finalization, and slower project starts. Despite the slight month-to-month softening, the index remains solidly in expansion territory, signaling continued growth in overall AV activity. Importantly, January’s AVI-S stands above year ago levels (51.5), reinforcing that underlying demand conditions entering 2026 are stronger than in early 2025.

January’s index reflects a combination of typical seasonal effects and broader macroeconomic conditions, including stable but still restrictive interest rates, cautious business investment, and soft nonresidential construction activity early in the year. Education, corporate, and live events markets all experienced slower starts as budgets reset, project timelines extended, and cost pressures persisted.

The January AV Employment Index (AVI-E) dropped by 1 point to 54.4. January 2026 the US labor market conditions appear stable but soft, with low layoffs and subdued hiring momentum.

International Outlook

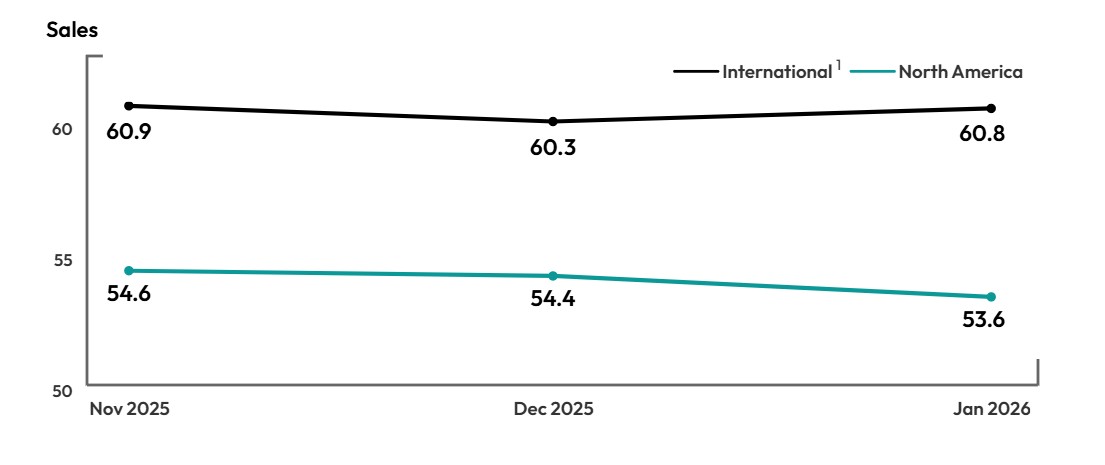

The North American AVI-S consistently remained above 50 at 53.6 a slight drop from 54.4 in December., The non-U.S. sales index also maintained steady growth, with the preliminary January sales index at 60.8, reflecting strong demand and positive sentiment from international companies. Outside North America, AV demand is most likely being reinforced by government backed investment, particularly in: Asia Pacific urban infrastructure, Middle East mega projects (transportation, tourism, education) and EU public modernization programs focused on digital collaboration, sustainability, and accessibility.

1Due to the small sample, the North American and International indexes are based on a 3-month moving average. The January 2026 index is preliminary, based on the average of January 2026 and December 2025 and will be final with February 2026 data in the next report.

1AVIXA®, the Audiovisual and Integrated Experience Association, has published the monthly Pro AV Business Index since September 2016, gauging sales and employment indicators for the pro AV industry. The index is calculated from a monthly survey that tracks trends. Two diffusion indexes are created using the survey: the AV Sales Index (AVI-S) and AV Employment Index (AVI-E). The diffusion indexes are calculated based on the positive response frequency from those who indicated their business had a 5% or more increase in billings/sales from the prior month plus half of the neutral response. An index of 50 indicates firms saw no increase or decline in business activity; more than 50 indicates an increase, while less than 50 indicates a decrease.

Uncertainty with the economy has significantly slowed customer spending and has limited project funding

AV Provider, North America

A few contracts closed at the end of 2025 to bolster business at the end of the year. Project awards for 2026 helped move forward into the New Year. Price fluctuations for equipment, materials, and shipping cost lead to a cautious outlook for the first two quarters of 2026. Tariffs are increasing manufacturer pricing; that they withheld or absorbed in 2025. Therefore, all budgets will increase in 2026, but the question is how much the integrator can add to our proposals and client billing.

AV Provider, Asia-Pacific

Economic uncertainty on both a global and local scale is making a lot of our customers back off. Especially churches. Businesses and government and large-scale construction projects that were already planned for 2026 - 2027 are still moving forward, but the small day-to-day projects from local schools and churches have really fallen off because no one knows what is going to happen next.

AV Provider, North America

Methodology

The survey behind the AVIXA Pro AV Business Index was fielded to 2,000 members of the AVIXA Insights Community between January 26, 2026 and February 3, 2026. A total of 289 AV professionals completed the survey. Only respondents who are service providers and said they were “moderately” to “extremely” familiar with their company’s business conditions were factored in index calculations. The AV Sales and AV Employment Indexes are computed as diffusion indexes. The monthly score is calculated as the percentage of firms reporting a significant increase plus half the percentage of firms reporting no change. Comparisons are always made to the previous month. Diffusion indexes, typically centered at a score of 50, are used frequently to measure change in economic activity. If an equal share of firms reports an increase as reports a decrease, the score for that month will be 50. A score higher than 50 indicates that firms, in the aggregate, are reporting an increase in activity that month compared to the previous month. In contrast, a score lower than 50 is a decrease in activity.

About the AVIXA Insights Community

The AVIXA AV Intelligence Panel (AVIP) is now part of AVIXA’s Insights Community, a research group of industry volunteers willing to share their insights on a regular basis to create actionable information. Members of the community are asked to participate in a short, two-to-three-minute monthly survey designed to gauge business sentiment and trends in the AV industry. Community members will also have the opportunity to participate in discussions, polls and surveys.

Community members will be eligible to:

- Earn points toward online gift cards

- Receive free copies of selected market research

- Engage directly with AVIXA's market intelligence team to help guide research

- Ask and answer other industry professionals' questions

The Insights Community is designed to be a global group, representative of the entire commercial AV value chain. AVIXA invites AV integrators, consultants, manufacturers, distributors, resellers, live events professionals, and AV technology managers to get involved. If you would like to join the community, enjoy benefits, and share your insights with the AV industry, please apply here